Economy

Amsterdam Metropolitan Area Competitiveness within the Netherlands

The AMA's economy is one of the strongest Metropolitan Areas in the Euro Zone. From 2005-2010, the gross regional product (GRP) of the AMA grew significantly faster than other metropolitan regions in the EU27 group of metropolitan areas (2% growth for AMA and an average of 1.3% for other Euro Zone metropolitan areas).

The Amsterdam Economic Board is a partnership between government, industry, and knowledge institutions with the aim of determining economic development strategies for the Metropolitan Area. Data collected by the Board is used to predict an Economic Outlook for the region and also make suggestions for which industries should expand and where.

The Amsterdam Economic Board is a partnership between government, industry, and knowledge institutions with the aim of determining economic development strategies for the Metropolitan Area. Data collected by the Board is used to predict an Economic Outlook for the region and also make suggestions for which industries should expand and where.

Sector Growth

|

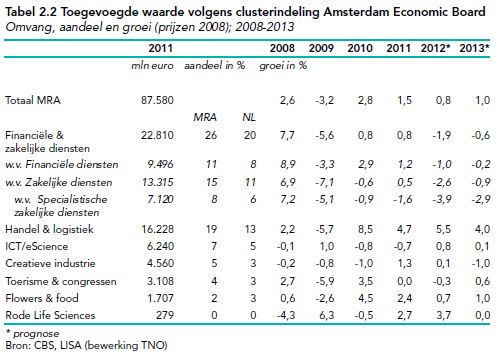

The tale to the left shows the growth or decline of industry sectors as a percent of GRP by year since the Great Recession. Similar economic sectors in this table have been grouped into related "clusters" by the Amsterdam Economic Board.

From 2008-2013, Financial and Business Services dominated AMA's economy, bringing in 22,810,000 Euros in 2011. The column "mln euro" is the millions of euros this cluster represents in GDP in 2011. MRA is the Dutch abbreviation for AMA and "aandeel in %" is the percent share of this cluster in national GDP. The percentages (column "groei in%") represent the yearly cluster growth or decline. AMA's GRP accounts for |

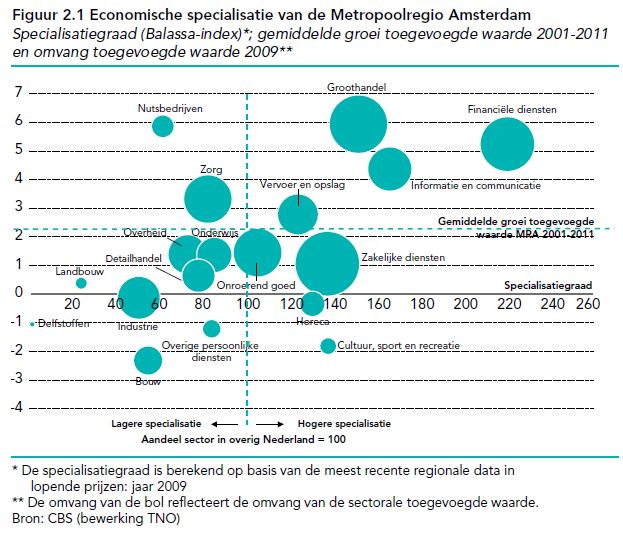

Overall, growth in the AMA in the last 10 years has been supported mainly by the internationally oriented sectors; namely Wholesale, Transport and Storage, Financial Services, and Information and Communication. These sectors represent the AMA's worldwide comparative economic advantage. The 2011 GRP of the AMA was 87.6 billion euros, representing about 17% of the total Dutch gross domestic product. Its diversity of economic sectors has made the AMA's economy particularly resilient. he AMA is and will continue to be a powerhouse of the Dutch economy for the foreseeable future.

The AMA strives to attract companies to the region. Every year sees new developments that keep Amsterdam at the head of the international business pack. Read more about the sub-region specializations; world class ports; multinational headquarter and major business centers; and what makes the AMA a global business metro.

The AMA strives to attract companies to the region. Every year sees new developments that keep Amsterdam at the head of the international business pack. Read more about the sub-region specializations; world class ports; multinational headquarter and major business centers; and what makes the AMA a global business metro.

Facts and figures drawn primarily from :

SEO Economisch Onderzoek (2009(, "Amsterdam, Netherlands: Self-Evaluation Report", OECD Reviews of Higher Education in Regional and City Development, IMHE

"Economische Verkenningen Metropoolregio Amsterdam 2012"

SEO Economisch Onderzoek (2009(, "Amsterdam, Netherlands: Self-Evaluation Report", OECD Reviews of Higher Education in Regional and City Development, IMHE

"Economische Verkenningen Metropoolregio Amsterdam 2012"